Current Ratio in Hindi- Current ratio क्या है, current assets का मतलब होता ही की उस कंपनी की संपत्ति को 1 वर्ष में cash में बदल सकते है. कंपनी के पास प्रोडक्ट्स जिन्हें कभी भी बेच सकते है. वह कंपनी के प्रोडक्ट को बेचकर 1 वर्ष के अन्दर पैसा मिल सकता है.

Current assets वह होते है जिनको 1 वर्ष के अन्दर बेचकर cash में बदल सके. इसी प्रकार current liabilities (कर्जा या देनदार) का मतलब होता है, जिन्हे 1 वर्ष में चुकाना होता है.

यदि कंपनी को किसी का पैसा 1 वर्ष में चुकाना हो तो वह कैसे चुकायगी. कंपनी के पास एक तरीका है वह अपने current assetes को बेचकर current liabilities (कर्जा) चूका सकती है. ऐसा तभी होगा जब कंपनी के Current Assets उसके current liabilities से अधिक होगा.

अब हम current ratio से पता करेंगे की Current Assets उसकी Current Liabilities से कितनी अधिक है.

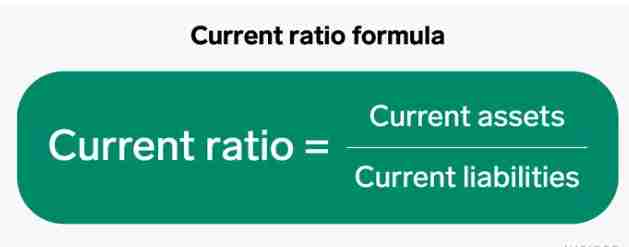

Current Ratio Formula क्या है?

जब भी आपको किसी कंपनी current ratio को जानना हो तो current assets को current liabilities को विभाजीत करना है जिससे आपके सामने current ratio निकल आयगा.

इन दोनों को आप कंपनी की balance sheet में देख सकते है. कंपनी प्रतेक वर्ष के ख़त्म होने बाद एक annual report देती है. कंपनी की annual report स्टॉक एक्सचेंज पर भी मिल जायगी.

इस report में Cash Flow Statement , Statements Profit & Loss Statement और Balance Sheet होते है. इतना ही नहीं बल्कि future plans की भी जानकारी मिलती है.

Current Ratio in Hindi (Current Ratio को एक उदहारण के तौर पर समझते है)

एक XYZ कंपनी है जिसके Current Assets 240 करोड़ और Current Liabilities 90 करोड़ है.

Current Ratio = 240 करोड़ / 90 करोड़

Current Ratio = 2.6

इसका मतलब है की यदि कंपनी के पास 1 रूपए की Current Liabilities है तो उसे चुकाने के लिए 2.5 रुपय है. इसे देखकर साफ़-साफ़ पता लग गया है की कंपनी अपनी सभी Current Liabilities को आसानी से चुका सकती है .

कंपनी का Current Ratio 1 से अधिक होना काफी ठीक होता है. ऐसे में निवेशको के लिए काफी खुसी की बात है क्योकि कंपनी समय से पहले अपने सभी दायित्व चूका सकती है.

इन्हें भी पढ़े –